Little Known Facts About Feie Calculator.

Wiki Article

4 Simple Techniques For Feie Calculator

Table of ContentsFeie Calculator Can Be Fun For AnyoneFeie Calculator Things To Know Before You BuyOur Feie Calculator StatementsFeie Calculator Fundamentals ExplainedFeie Calculator Can Be Fun For Anyone

He sold his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his wife to assist fulfill the Bona Fide Residency Test. Neil directs out that acquiring home abroad can be challenging without first experiencing the location."It's something that individuals need to be actually attentive about," he states, and suggests expats to be cautious of common blunders, such as overstaying in the U.S.

Neil is careful to cautious to Tension tax authorities tax obligation "I'm not conducting any performing any kind of Service. The United state is one of the couple of nations that taxes its people regardless of where they live, indicating that even if a deportee has no revenue from United state

tax return. "The Foreign Tax obligation Credit report enables individuals working in high-tax nations like the UK to counter their U.S. tax obligation by the amount they've already paid in taxes abroad," says Lewis.

Little Known Facts About Feie Calculator.

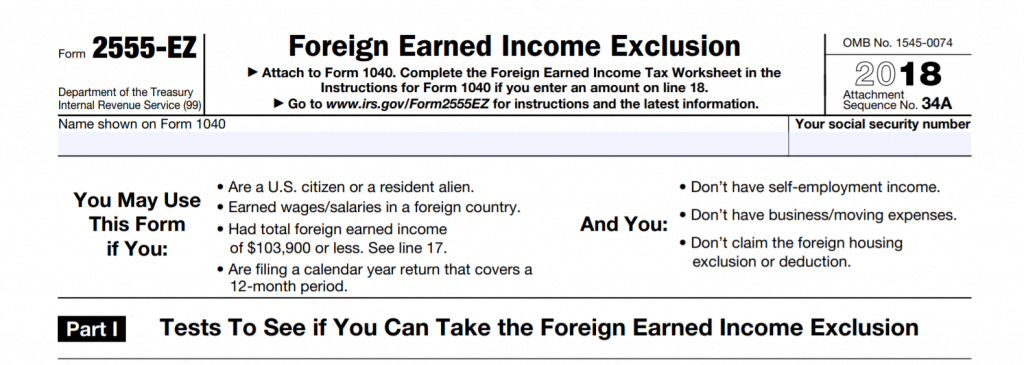

Below are several of the most often asked concerns about the FEIE and various other exclusions The International Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out as much as $130,000 of foreign-earned revenue from federal earnings tax, minimizing their U.S. tax liability. To get FEIE, you have to satisfy either the Physical Visibility Test (330 days abroad) or the Bona Fide Home Examination (verify your main residence in a foreign country for an entire tax year).

The Physical Visibility Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Examination additionally calls for U.S. taxpayers to have both an international income and an international tax obligation home. A tax home is specified as your prime place for company or employment, despite your household's house.

The Ultimate Guide To Feie Calculator

A revenue tax treaty in between the U.S. and an additional nation can aid stop dual taxation. While the Foreign Earned Revenue Exemption decreases taxed earnings, a treaty may give fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declare united state people with over $10,000 in international monetary accounts.Qualification for FEIE relies on conference certain residency or physical presence examinations. is a tax obligation consultant on the Harness system and the owner of Chessis Tax. He belongs to the National Association of Enrolled Brokers, the Texas Culture of Enrolled Agents, and the Texas Culture of CPAs. He brings over a years of experience helping Big 4 firms, encouraging expatriates and high-net-worth people.

Neil Johnson, CPA, is a tax expert on the Harness platform and the founder of The Tax obligation Man. He has more than thirty years of experience and now focuses on CFO services, equity payment, copyright taxes, cannabis tax and separation related tax/financial planning issues. He is an expat based in Mexico - https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator.

The international earned income exemptions, occasionally referred to as the Sec. 911 exclusions, exclude tax on salaries earned from working abroad. The exemptions comprise 2 parts - an income exemption and a real estate exemption. The following FAQs go over the advantage of the exclusions consisting of when both partners are expats in a general manner.

The Basic Principles Of Feie Calculator

The tax obligation benefit omits the income from tax obligation at bottom tax obligation rates. Previously, the exemptions "came original site off the top" reducing income subject to tax obligation at the top tax obligation rates.These exclusions do not excuse the wages from US taxes however merely give a tax reduction. Note that a single person working abroad for all of 2025 who gained concerning $145,000 without other earnings will have gross income lowered to zero - effectively the exact same answer as being "tax free." The exclusions are computed on an everyday basis.

Report this wiki page